The Biden-Harris Administration recently announced an update on the timing of the payment count adjustment. This administrative fix ensures borrowers get proper credit for progress borrowers made toward income-driven repayment (IDR) forgiveness and Public Service Loan Forgiveness (PSLF).

The payment count adjustment is now anticipated to be fully implemented in September 2024. At that time, borrowers with Direct Loans or Federal Family Education Loan (FFEL) Program loans held by the U.S. Department of Education (Department) will see a full and accurate count of their progress toward loan forgiveness.

Because of this updated timeline, borrowers with non-federally held FFEL loans who apply to consolidate by June 30 can still benefit from the payment count adjustment. The prior consolidation deadline was April 30.

Borrowers with non-federally held FFEL loans!

— U.S. Department of Education (@usedgov) May 15, 2024

You now have until June 30 to consolidate your loans & benefit from an adjustment to count previous payments toward income-driven repayment (IDR) forgiveness & Public Service Loan Forgiveness (PSLF).

Learn More:… pic.twitter.com/ELWraggZzO

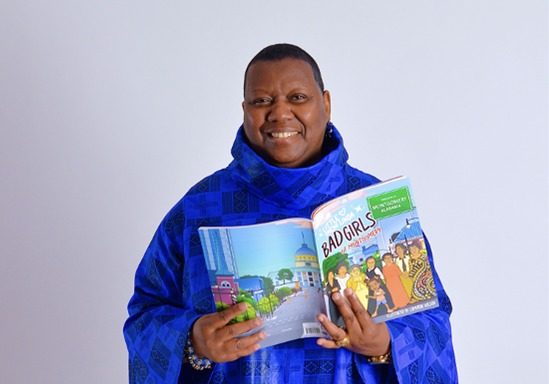

“The Department is working swiftly to ensure borrowers get credit for every month they’ve rightfully earned toward forgiveness,” said U.S. Under Secretary of Education James Kvaal. “FFEL borrowers should consolidate as soon as possible to receive this benefit that has already provided forgiveness to nearly 1 million borrowers.”

The Department first announced the payment count adjustment in April 2022 to address extensive evidence, including from the U.S. Government Accountability Office, that borrowers did not have a proper accounting of their time to forgiveness under IDR plans as well as widespread evidence that servicers had not been properly following regulations and Department contracts governing the use of forbearances, resulting in borrowers spending excessive amounts of time in forbearances.

To rectify these problems and ensure an accurate count going forward, the payment count adjustment automatically counts months in the following statuses:

• Any months in a repayment status, regardless of the payments made, loan type, or repayment plan;

• Twelve or more months of consecutive forbearance or 36 or more months of cumulative forbearance;

• Any months spent in economic hardship or military deferments in 2013 or later;

• Any months spent in any deferment (except for in-school deferment) before 2013; and

• Any time in repayment (or deferment or forbearance, if applicable) on earlier loans before consolidation of those loans into a consolidation loan.

Borrowers also can receive credit toward PSLF for any month covered by the payment count adjustment as long as they certify their qualifying employment for that month.

The Department has already been identifying borrowers eligible for forgiveness under the payment count adjustment so they can get their relief without waiting for the adjustment to finish.

Starting in August 2023, the Department began identifying and, following an opt-out period, automatically discharging borrowers whose updated payment counts were sufficient to reach forgiveness after 20 or 25 years of payments, as well as borrowers who reached the required 120 months of repayment and certified employment for PSLF.

Borrowers are eligible for IDR forgiveness whether they are currently enrolled in an IDR plan or not because part of the problem identified was borrowers not getting complete and accurate information that would have allowed them to access IDR.

Through this action, the Department has approved $49.2 billion in forgiveness for more than 996,000 borrowers. This number does not include borrowers who received PSLF at least in part due to the account adjustment.

While the Department continues to identify borrowers who have reached those forgiveness thresholds, “we are still working to implement changes that will give all borrowers an accurate count of their payments.” Those changes are now expected to be completed in September instead of July. When the Department finishes processing the account adjustment in September 2024, it will ensure that the adjustment has been applied to any loan held by the Department at that time.

The payment count adjustment will be processed automatically for all Direct Loan borrowers without further action on their part.

Borrowers with FFEL Program loans held by the Department will also receive the account adjustment automatically but must consolidate into the Direct Loan Program if they want to count any prior time in repayment toward PSLF.

Borrowers with any other federal loan type would need to consolidate to Direct Loans to receive the payment count adjustment. That includes borrowers with commercial FFEL loans or any type of Perkins loan. Based upon this updated timeline, borrowers who need to consolidate to benefit from the payment count adjustment or count periods toward PSLF must apply to consolidate by June 30.

The Department has previously released information about eligibility requirements and how to understand what loans are eligible for this benefit and how to consolidate. Borrowers can also learn more at StudentAid.gov/idradjustment.

Borrowers who aren’t sure what kind of loans they have can find out by logging in to StudentAid.gov. On their dashboard, they can click the “Loan Breakdown” section to view a list of their loans. Direct Loans begin with the word “Direct.” Federal Family Education Loan Program loans begin with “FFEL.” Perkins Loans include the word “Perkins” in the name.

If the name of your servicer starts with “Dept. of Ed” or “Default Management Collection System,” your FFEL or Perkins loan is federally managed (i.e., held by the Department).

Unwavering commitment to relief

The Biden-Harris Administration remains committed to using all available tools to deliver the federal student loan relief that borrowers and their families deserve. In total, the Administration has approved almost $160 billion in relief for nearly 4.6 million borrowers, including:

• $62.8 billion in relief for more than 876,000 individuals through the Public Service Loan Forgiveness (PSLF) program

• $49.2 billion for more than 996,000 borrowers through improvements to IDR that addressed longstanding administrative failure and the misuse of forbearance by loan servicers.

• $4.8 billion for almost 360,000 borrowers on the SAVE Plan. These are borrowers who originally took out smaller loans for their post-secondary studies.

• $28.7 billion for 1.6 million borrowers who were cheated by their schools, saw their institutions precipitously close, or are covered by related court settlements.

• $14.1 billion for more than 548,000 borrowers with a total and permanent disability.